What is an Equity Linked Saving Scheme (ELSS)?

An Equity Linked Saving Scheme is a diversified equity mutual fund that gives youthe dual benefit of tax savings with the growth potential of equities. But unlike other tax saving investments, ELSS has a lock-in period of just 3 years, which is the lowest! You could invest in ELSS through a Systematic Investment Plan (SIP) andalso benefit from rupee-cost-averaging and compounding. ELSS could be the ideal option to help beat rising inflation in the long term and help grow your money.

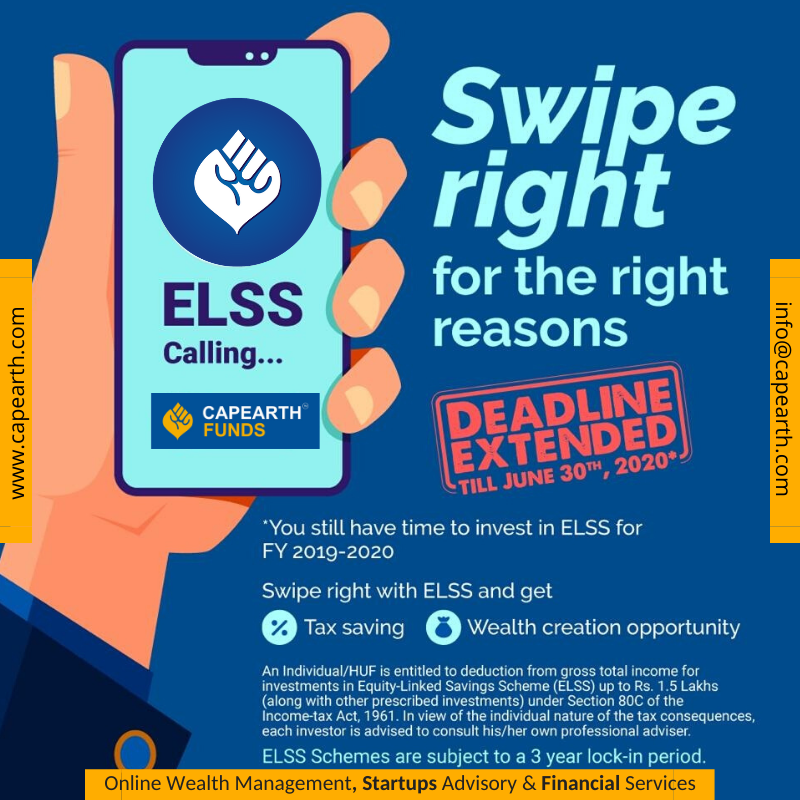

Key Benefits of Tax Saving ELSS Mutual Fund

– Dual benefits (Wealth Creation & Tax Saving)

– Shortest lock-in of 3 years

– Minimum investment of Rs 500/-

– LTCG exempt upto Rs 1,00,000/-

– Save upto Rs 46,800/-